Eligibility Guidelines

The borrowing company, together with affiliates, must meet certain requirements in order to be eligible for the benefits of the 504 Loan Program —

- Business size: Net worth less than $20,000,000; average net profit after tax not greater than $6,500,000 for the past two years

- Employment: Meets one of a variety of goals

- User of asset: Operating Company must be primary user

- Industry: Very few exclusions

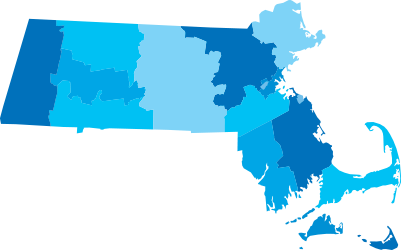

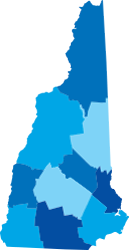

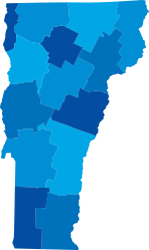

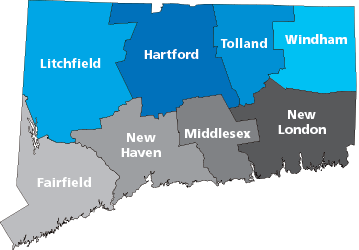

Areas We Serve

Statewide

Statewide

Statewide

Statewide

Statewide

Statewide

Statewide

Statewide

Litchfield, Hartford, Tolland, and Windham Counties

Litchfield, Hartford, Tolland, and Windham Counties

Size of Business

The tangible net worth of the borrowing company, including affiliates and other companies under common control, cannot exceed $20,000,000. The average NPAT (net profit-after-tax) for the most recent two years (excluding loss carry-forwards) cannot exceed $6,500,000 per year. Stated another way, the total NPAT for the past two years cannot exceed $13,000,000. If this maximum is exceeded, alternative size standards may be used in certain instances.

Employment

Each project must meet at least one of a broad range of economic development objectives. An economic development objective is met if the project meets a community development goal or a public policy goal (as defined by the Section 504 Loan Program) or creates or retains one job for each $90,000 with standard 504 projects; $140,000 for manufacturing and energy public policy projects; or $100,000 for HUB or Opportunity zone projects, of debenture assistance.

User of Asset

The asset being financed must be used by the operating company (or companies). Real estate must be owner-occupied as defined by the Section 504 Loan Program. There are two definitions of owner-occupancy, one for existing buildings and another for new construction:

- Existing buildings: The operating company (or companies) must occupy at least 51% of the space

- Newly constructed buildings: The operating company (or companies) must initially occupy at least 60% of the available space and plan to commence expansion into the remaining space within three years such that it will occupy at least 80% of the facility by the end of the tenth year. In other words, up to 20% of the facility may be leased permanently to an unrelated third party.

Industry Exclusions

Not-for-profit organizations, investment firms, financial institutions, most gambling facilities, and businesses engaged in the production, distribution, or presentation of products or services of a prurient sexual nature are not eligible for Section 504 financing.

Ownership Structure

The operating company may be organized as a corporation, partnership, proprietorship, limited liability company, or producers’ cooperative. A passive entity such as a realty trust, partnership, subchapter S corporation, etc. may be the borrower and lease the property to the operation company. There is no requirement that there be any common ownership between the operating company and the passive entity that owns the real estate. However, the loan must be guaranteed by the operating company as well as each holder or married couple with a 20% or more interest in either the operating company or the passive real estate entity.