Bay Colony Development Corp. in the News

Paycheck Protection Program Updates

Update 4/10/2020: Please refer to the SBA and Treasury websites for the latest program guidelines, as there have been updates almost daily to the program parameters.

The Small Business Administration and the Treasury Department have released details on how Borrowers and Lenders will be able to process applications for the Paycheck Protection Program. Please note that these applications will be processed by any bank, credit union or lender that is approved to process SBA 7a loans. Below please find borrower and lender information and the application link for the Paycheck Protection Program below. Your banks and bankers will be very busy assisting many small businesses, so please gather your documents and schedule a time to discuss your application with your banker. Links to the Treasury Department site and the SBA Paycheck Protection Program page are included for additional references.

Paycheck Protection Program Overview

The Paycheck Protection Program provides small businesses with funds to pay up to 8 weeks of

payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and

utilities.

Fully Forgiven

Funds are provided in the form of loans that will be fully forgiven when used for payroll costs,

interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the

forgiven amount must have been used for payroll). Loan payments will also be deferred for six

months. No collateral or personal guarantees are required. Neither the government nor lenders

will charge small businesses any fees.

Must Keep Employees on the Payroll—or Rehire Quickly

Forgiveness is based on the employer maintaining or quickly rehiring employees and

maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if

salaries and wages decrease.

All Small Businesses are Eligible

Small businesses with 500 or fewer employees—including nonprofits, veterans organizations,

tribal concerns, self-employed individuals, sole proprietorships, and independent contractors

are eligible. Businesses with more than 500 employees are eligible in certain industries.

When to Apply

Starting April 3, 2020, small businesses and sole proprietorships can apply. Starting April 10,

2020, independent contractors and self-employed individuals can apply. We encourage you to

apply as quickly as you can because there is a funding cap.

How to Apply

You can apply through any existing SBA 7(a) lender or through any federally insured depository

institution, federally insured credit union, and Farm Credit System institution that is

participating. Other regulated lenders will be available to make these loans once they are

approved and enrolled in the program. You should consult with your local lender as to whether

it is participating. All loans will have the same terms regardless of lender or borrower. A list of

participating lenders as well as additional information and full terms can be found at

www.sba.gov.

Borrower Information

The Paycheck Protection Program (“PPP”) authorizes up to $349 billion in forgivable loans to

small businesses to pay their employees during the COVID-19 crisis. All loan terms will be the

same for everyone.

The loan amounts will be forgiven as long as:

The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and

utility costs over the 8 week period after the loan is made; and

Employee and compensation levels are maintained.

Payroll costs are capped at $100,000 on an annualized basis for each employee. Due to likely

high subscription, it is anticipated that not more than 25% of the forgiven amount may be for

non-payroll costs.

Loan payments will be deferred for 6 months.

When can I apply?

Starting April 3, 2020, small businesses and sole proprietorships can apply for and

receive loans to cover their payroll and other certain expenses through existing SBA

lenders.

Starting April 10, 2020, independent contractors and self-employed individuals can

apply for and receive loans to cover their payroll and other certain expenses through

existing SBA lenders.

Other regulated lenders will be available to make these loans as soon as they are

approved and enrolled in the program.

Where can I apply?

You can apply through any existing SBA lender or through any federally

insured depository institution, federally insured credit union, and Farm Credit System institution

that is participating. Other regulated lenders will be available to make these loans once they are

approved and enrolled in the program. You should consult with your local lender as to whether it

is participating. Visit www.sba.gov for a list of SBA lenders.

Who can apply?

All businesses – including nonprofits, veterans organizations, Tribal business

concerns, sole proprietorships, self-employed individuals, and independent contractors – with

500 or fewer employees can apply. Businesses in certain industries can have more than 500

employees if they meet applicable SBA employee-based size standards for those industries (click

HERE for additional detail).

For this program, the SBA’s affiliation standards are waived for small businesses (1) in the hotel

and food services industries (click HERE for NAICS code 72 to confirm); or (2) that are

franchises in the SBA’s Franchise Directory (click HERE to check); or (3) that receive financial

assistance from small business investment companies licensed by the SBA. Additional guidance

may be released as appropriate.

What do I need to apply?

You will need to complete the Paycheck Protection Program loan

application and submit the application with the required documentation to an approved lender

that is available to process your application by June 30, 2020. Click HERE for the application.

What other documents will I need to include in my application?

You will need to provide

your lender with payroll documentation.

Do I need to first look for other funds before applying to this program?

No. We are waiving

the usual SBA requirement that you try to obtain some or all of the loan funds from other sources

(i.e., we are waiving the Credit Elsewhere requirement).

How long will this program last?

Although the program is open until June 30, 2020, we

encourage you to apply as quickly as you can because there is a funding cap and lenders need

time to process your loan.

How many loans can I take out under this program?

Only one.

What can I use these loans for?

You should use the proceeds from these loans on your:

Payroll costs, including benefits;

Interest on mortgage obligations, incurred before February 15, 2020;

Rent, under lease agreements in force before February 15, 2020; and

Utilities, for which service began before February 15, 2020.

What counts as payroll costs? Payroll costs include:

Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each

employee);

Employee benefits including costs for vacation, parental, family, medical, or sick leave;

allowance for separation or dismissal; payments required for the provisions of group

health care benefits including insurance premiums; and payment of any retirement

benefit;

State and local taxes assessed on compensation; and

For a sole proprietor or independent contractor: wages, commissions, income, or net

earnings from self-employment, capped at $100,000 on an annualized basis for each

employee.

How large can my loan be?

Loans can be for up to two months of your average monthly

payroll costs from the last year plus an additional 25% of that amount. That amount is subject to

a $10 million cap. If you are a seasonal or new business, you will use different applicable time

periods for your calculation. Payroll costs will be capped at $100,000 annualized for each

employee.

How much of my loan will be forgiven?

You will owe money when your loan is due if you use

the loan amount for anything other than payroll costs, mortgage interest, rent, and utilities

payments over the 8 weeks after getting the loan. Due to likely high subscription, it is anticipated

that not more than 25% of the forgiven amount may be for non-payroll costs.

You will also owe money if you do not maintain your staff and payroll.

Number of Staff: Your loan forgiveness will be reduced if you decrease your full-time

employee headcount.

Level of Payroll: Your loan forgiveness will also be reduced if you decrease salaries and

wages by more than 25% for any employee that made less than $100,000 annualized in

2019.

Re-Hiring: You have until June 30, 2020 to restore your full-time employment and

salary levels for any changes made between February 15, 2020 and April 26, 2020.

How can I request loan forgiveness?

You can submit a request to the lender that is servicing

the loan. The request will include documents that verify the number of full-time equivalent

employees and pay rates, as well as the payments on eligible mortgage, lease, and utility

obligations. You must certify that the documents are true and that you used the forgiveness

amount to keep employees and make eligible mortgage interest, rent, and utility payments. The

lender must make a decision on the forgiveness within 60 days.

What is my interest rate?

1.00% fixed rate.

When do I need to start paying interest on my loan?

All payments are deferred for 6 months;

however, interest will continue to accrue over this period.

When is my loan due?

In 2 years.

Can I pay my loan earlier than 2 years?

Yes. There are no prepayment penalties or fees.

Do I need to pledge any collateral for these loans?

No. No collateral is required.

Do I need to personally guarantee this loan?

No. There is no personal guarantee requirement.

***However, if the proceeds are used for fraudulent purposes, the U.S. government will pursue

criminal charges against you.***

What do I need to certify?

As part of your application, you need to certify in good faith that:

Current economic uncertainty makes the loan necessary to support your ongoing

operations.

The funds will be used to retain workers and maintain payroll or to make mortgage,

lease, and utility payments.

You have not and will not receive another loan under this program.

You will provide to the lender documentation that verifies the number of full-time

equivalent employees on payroll and the dollar amounts of payroll costs, covered

mortgage interest payments, covered rent payments, and covered utilities for the eight

weeks after getting this loan.

Loan forgiveness will be provided for the sum of documented payroll costs, covered

mortgage interest payments, covered rent payments, and covered utilities. Due to likely

high subscription, it is anticipated that not more than 25% of the forgiven amount may

be for non-payroll costs.

All the information you provided in your application and in all supporting documents

and forms is true and accurate. Knowingly making a false statement to get a loan under

this program is punishable by law.

You acknowledge that the lender will calculate the eligible loan amount using the tax

documents you submitted. You affirm that the tax documents are identical to those you

submitted to the IRS. And you also understand, acknowledge, and agree that the lender

can share the tax information with the SBA’s authorized representatives, including

authorized representatives of the SBA Office of Inspector General, for the purpose of

compliance with SBA Loan Program Requirements and all SBA reviews.

Lender Information

Who is eligible to lend?

All existing SBA-certified lenders will be given delegated authority to speedily process PPP loans.

All federally insured depository institutions, federally insured credit unions, and Farm Credit

System institutions are eligible to participate in this program.

A broad set of additional lenders can begin making loans as soon as they are approved and

enrolled in the program. New lenders will need to submit their application to

DelegatedAuthority@sba.gov to apply with the SBA.

Are these loans guaranteed by the SBA?

Yes, the SBA guarantees 100% of the outstanding

balance, and that guarantee is backed by the full faith and credit of the United States.

Are there guarantee fees?

The SBA waives all SBA guaranty fees, including the upfront and

annual servicing fees.

What underwriting is required?

You will need to verify that a borrower was in operation on

February 15, 2020. You will need to verify that a borrower had employees for whom the

borrower paid salaries and payroll taxes. You will need to verify the dollar amount of average

monthly payroll costs. You will need to follow applicable Bank Secrecy Act requirements.

How will lenders be compensated?

Processing fees will be based on the balance of the

financing outstanding at the time of final disbursement:

Loans $350,000 and under: 5.00%

Loans greater than $350,000 to $2 million: 3.00%

Loans greater than $2 million: 1.00%

Lenders may not collect any fees from the applicant.

Who can be an agent? An agent is an authorized representative and can be:

An attorney;

An accountant;

A consultant;

Someone who prepares an applicant’s application for financial assistance and is

employed and compensated by the applicant;

Someone who assists a lender with originating, disbursing, servicing, liquidating, or

litigating SBA loans;

A loan broker; or

Any other individual or entity representing an applicant by conducting business with the

SBA.

How will agents be compensated?

Agent fees will be paid out of lender fees. The lender will

pay the agent. Agents may not collect any fees from the applicant.

Loans $350,000 and under: 1.00%

Loans greater than $350,000 to $2 million: 0.50%

Loans greater than $2 million: 0.25%

Can these loans be sold in the secondary market?

PPP loans can be sold in the secondary

market. The SBA will not collect any fee for any guarantee sold into the secondary market.

Small Business Assistance Loans via Stimulus Bill and EIDL Loan Updates

Small Business Assistance Loans via Stimulus Bill

We congratulate our nation’s congressional leaders on coming to an agreement and passing a $2.2 trillion emergency spending bill to combat the economic impact of coronavirus. As we understand it, the bill includes approximately $350 billion aimed at helping small businesses weather the economic storm.

The $2.2 trillion coronavirus stimulus bill enacted by Congress on March 27 provides immediate cash assistance to small businesses that keep their employees or recall employees they have furloughed or laid off due to financial hardships related to COVID-19. The money is available through a Small Business Administration (SBA) loan program that allows businesses to keep the loan proceeds as a grant for eligible expenses, including payroll, for the period between February 15 and June 30, 2020.

This program, called the Paycheck Protection Program (PPP), is a powerful tool for businesses with fewer than 500 employees to get immediate assistance with meeting operating expenses, with the prospect of not having to repay some or all of the loan. It’s also available for nonprofits.

Here are the highlights of the program:

Maximum Loan Amount

- The PPP raises the maximum amount for an SBA loan by 2.5x the average total monthly payroll cost, or up to $10 million. The interest rate may not exceed 4%.

Qualified Costs

- Payroll costs

- Continuation of health care benefits

- Employee compensation (for those making less than $100,000)

- Mortgage interest obligations

- Rent on any lease in force prior to February 15, 2020

- Utilities

- Interest on debt incurred before the covered period

Businesses Eligible to Obtain These Loans

- Businesses with fewer than 500 employees.

- Small businesses as defined by the Small Business Administration (SBA) Size Standards at 13 C.F.R. 121.201.

- 501(c)(3) nonprofits, 501(c)(19) veteran’s organization, and Tribal business concern described in section 31(b)(2)(C) of the Small Business Act with not more than 500 employees.

- Hotels, motels, restaurants, and franchises with fewer than 500 employees at each physical location without regard to affiliation under 13 C.F.R. 121.103.

- Businesses that receive financial assistance from Small Business Investment Act Companies licensed under the Small Business Investment Act of 1958 without regard to affiliation under 13 C.F.R. 121.10.

- Sole proprietors and independent contractors.

Loan Forgiveness

All or a portion of the loan may be forgivable, and debt service payments may be deferred for up to one year. The amount forgiven will be reduced proportionally by any reduction in employees retained compared to the prior year and reduced by the reduction in pay of any employee beyond 25% of their prior year compensation. To encourage employers to rehire any employees who have already been laid off due to the COVID-19 crisis, borrowers that rehire workers previously laid off will not be penalized for having a reduced payroll at the beginning of the period.

Application Process

Current banks and credit union lenders through the Small Business Administration 7(a) are authorized to make determinations on borrower eligibility and creditworthiness without going through the SBA. For eligibility purposes, lenders will not be determining eligibility based on repayment ability, but rather whether the business was operational on February 15, 2020, and had employees for whom it paid salaries and payroll taxes, or a paid independent contractor.

Timeline

The SBA is required to issue implementing regulations within 15 days, and the U.S. Department of Treasury will be approving new lenders. Until this time, lenders will not have the information available to process applications.

Economic Injury Disaster Loan (EIDL) Update

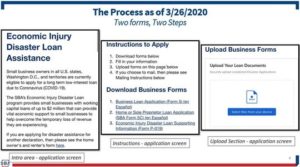

As of 3/26/20, the Disaster Loan Assistance portal has been revamped and the process has been simplified!

You now are only required to upload two (2) forms to initiate the process:

SBA Form 5/5C

Business Loan Application (Form 5) (en Español)

or

Home or Sole Proprietor Loan Application (SBA Form 5C) (en Español)

Form P-019

Economic Injury Disaster Loan Supporting Information (Form P-019)

If you already submitted an application and want to check on status, please call customer service at 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov

Instructions from the website follow below…

Economic Injury Disaster Loan Assistance

Small business owners in all U.S. states, Washington D.C., and territories are currently eligible to apply for a long-term, low-interest loan due to Coronavirus (COVID-19).

The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

If you are applying for disaster assistance for another declaration, then please see the home owner’s and renter’s form here.

Instructions to Apply

- Download forms below

- Fill in your information

- Upload forms on this page below

- If you choose to mail, then please see Mailing Instructions below

Download Business Forms

- Business Loan Application (Form 5)(en Español)

- Home or Sole Proprietor Loan Application (SBA Form 5C)(en Español)

- Economic Injury Disaster Loan Supporting Information (Form P-019)

Additional Forms

A Disaster Assistance loan officer may request you to fill out the following additional forms:

- Fee Disclosure Form and Compensation Agreement (Form 159D)

- Personal Financial Statement (SBA Form 413D)(en Español)

- Request for Transcript of Tax Return (IRS Form 4506-T)

- Instructions for Request for Transcript of Tax Return (IRS Form 4506-T)(en Español)

- Schedule of Liabilities (SBA Form 2202)

- Instructions for Schedule of Liabilities (SBA Form 2202)

- Schedule of Liabilities (SBA Form 2202) (en Español)

- PUERTO RICO ONLY: Release of Inheritance and Donation (Modelo SC 2907) (en Español)

- PUERTO RICO ONLY: Hacienda Statement of Authorization

- Additional Filing Requirements (SBA Form 1368)

SBA 504 Rates Drop to Historic Low Levels

Current Rates

25 Year Rate- 3.07%

20 Year Rate- 2.94%

10 Year Rate- 2.72%

The March Funding Rates for 10, 20 and 25 Year SBA 504 projects have dropped to Historic Low Levels. Contact us to discuss the advantages of using the SBA 504 loan program for your borrowers.

25 and 20 Year Rate as of March 2020, 10 Year Rate as of March 2020. Above Rates are the All In Rate which are calculated by adding the note rate and servicing fees.

Bay Colony Development President & CEO Mary Katherine Mansfield’s Witness Testimony at The House Small Business Committee- SBA 504 Loan Modernization

Bay Colony Staff Contributes to Toys for Tots

The Staff at Bay Colony is happy to continue our tradition this year of supporting the Toys for Tots mission of providing a new, unused toy for less fortunate children in the community. With contributions from the staff and a matching contribution from the company we were able to purchase over $900 worth of toys this year. We hope that you will consider joining us and contributing to your favorite organization. Happy Holidays!